How To Set Up A 501c3 In Michigan

How to Start a Nonprofit

Apply our free nonprofit formation guide to create your own 501c3 nonprofit in vii elementary steps. To get started, simply select the land in which you wish to form your new business.

For more information on nonprofits and how they function, read our What is a Nonprofit Corporation article before you start.

Or, merely employ a professional service:

Northwest (Starting at $39 + Land Fees)

Starting a nonprofit is easy, just follow these simple steps:

To larn more well-nigh starting a nonprofit corporation in a specific office of the United states, select your land below:

- Alabama 501c3

- Alaska 501c3

- Arizona 501c3

- Arkansas 501c3

- California 501c3

- Colorado 501c3

- Connecticut 501c3

- Delaware 501c3

- Florida 501c3

- Georgia 501c3

- Hawaii 501c3

- Idaho 501c3

- Illinois 501c3

- Indiana 501c3

- Iowa 501c3

- Kansas 501c3

- Kentucky 501c3

- Louisiana 501c3

- Maine 501c3

- Maryland 501c3

- Massachusetts 501c3

- Michigan 501c3

- Minnesota 501c3

- Mississippi 501c3

- Missouri 501c3

- Montana 501c3

- Nebraska 501c3

- Nevada 501c3

- New Hampshire 501c3

- New Bailiwick of jersey 501c3

- New Mexico 501c3

- New York 501c3

- Due north Carolina 501c3

- North Dakota 501c3

- Ohio 501c3

- Oklahoma 501c3

- Oregon 501c3

- Pennsylvania 501c3

- Rhode Island 501c3

- South Carolina 501c3

- S Dakota 501c3

- Tennessee 501c3

- Texas 501c3

- Utah 501c3

- Vermont 501c3

- Virginia 501c3

- Washington 501c3

- Washington D.C. 501c3

- West Virginia 501c3

- Wisconsin 501c3

- Wyoming 501c3

Step 1: Name Your Nonprofit

Choosing a name for your nonprofit organization is the first and most important footstep in starting your nonprofit corporation. Be sure to choose a name that complies with your state's naming requirements and is easily searchable by potential members and donors.

Is the URL available? Nosotros recommend that yous cheque to encounter if your business name is available as a spider web domain. Even if you lot don't plan to make a business website today, you lot may desire to buy the URL in order to prevent others from acquiring it.

Discover a Domain At present

Registered your domain proper noun? Next, nosotros suggest choosing a business organization phone system to assist your nonprofit build authority and trust. Phone.com is our first selection due to its affordability and top-notch customer support. Endeavour Phone.com today.

Step 2: Choose a Registered Agent

Your nonprofit is required to nominate a registered agent from your state for your organization. Check out our How to Choose a Registered Agent for Your Nonprofit guide for more data about choosing the all-time registered amanuensis for your small business.

What is a Registered Agent? A registered amanuensis is an private or business organisation entity responsible for receiving important legal documents on behalf of your business concern. Call up of your registered agent as your business organisation' point of contact with the state.

Who tin can exist a Registered Agent? A registered agent must be a resident of your state or a corporation, such as a registered agent service, authorized to transact business in your state. Y'all may elect an individual within the company including yourself.

Stride 3: Select Your Directors & Officers

The directors of an organization come together to form a board of directors. This board of directors is responsible for overseeing the operations of the nonprofit.

The president, secretarial assistant, and other members of nonprofit who have individual responsibilities and authorities are known as officers.

The system structure of your nonprofit in MUST include:

- At least 3 directors not related to each other

Step 4: Adopt Bylaws & Conflict of Interest Policy

To be eligible to utilise for 501c3 condition, your nonprofit is required to have the post-obit two documents:

- Bylaws

- Conflict of involvement policy

What are Bylaws? Bylaws are the rules outlining the operating procedures of the nonprofit.

What is a Conflict of Interest Policy? A Conflict of Interest Policy is the collection of rules put in place to ensure that any decisions fabricated by the board of directors or the officers, benefits the nonprofit and not individual members.

NOTE: The bylaws and conflict of interest policy must exist adopted by the nonprofit during its first organizational meeting where the lath of directors and officers are officially appointed.

Step v: File the Manufactures of Incorporation

To register your nonprofit, you will need to file the Manufactures of Incorporation with your state.

To ensure that your nonprofit is eligible to utilize for 501c3, in your manufactures of incorporation you must explicitly state the following:

i. Purpose

In gild to qualify for 501(c)(3) condition, the arrangement'due south purpose must explicitly exist limited to ane or more of the following:

- Charitable, Religious, Scientific, Educational, Literary, Fostering national/international amateur sports competition, Preventing cruelty to animals/children, Testing for public safety,

two. Dissolution

You must explicitly state what the avails of the arrangement will be used for, and what volition happen to the assets if the organization is dissolved.

To be eligible for 501(c)(3) status, the assets of your organization must only ever be used for purposes approved nether section 501(c)(3).

Department v of this sample IRS document provides an example of these provisions required for 501(c)(3) eligibility.

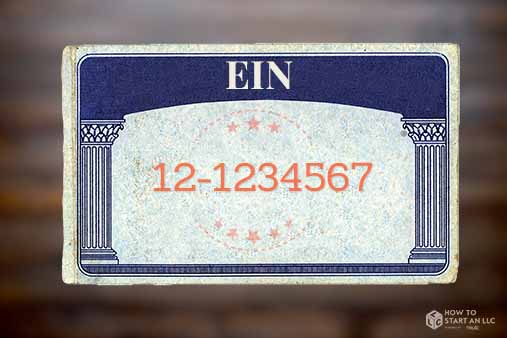

Footstep vi: Become an EIN

What is an EIN? An Employer Identification Due northumber (EIN), or Federal Tax Identification Number (FTIN), is used by the federal government to identify a business entity. Information technology is essentially a social security number for the company.

Why practise I demand an EIN? An EIN is required for the post-obit:

- To open a business organization bank business relationship for the visitor

- For Federal and Country revenue enhancement purposes

- To hire employees for the company

How do I become an EIN? An EIN is obtained from the IRS (gratuitous of charge) by the business owner after forming the company. This can exist done online or by postal service. Cheque out our EIN Lookup guide for more data.

Pace 7: Apply for 501(c)(3) Status

Earlier a nonprofit can apply for 501(c)(3) condition it must:

- Elect at least three directors non related to each other

- File the Articles of Incorporation with the required provisions (As covered in Step 5)

- Adopt the bylaws and disharmonize of interest policy

- Take an EIN number

One time these iv conditions take been met, your nonprofit can apply for 501(c)(iii) tax-exempt status by filing Form-1023 online.

If your awarding is approved, the IRS volition transport you lot a determination letter stating that your organization is exempt from federal taxes under section 501(c)(iii).

FAQ

When should an organization apply for federal taxation exemption?

Form 1023 must exist filed within 27 months from the end of the first month your organization was created.

How long will it have for the IRS to process Class 1023/1023-EZ?

Before long after sending your application y'all should receive an acknowledgement of receipt of your application.

If your awarding is unproblematic and complete, IRS will ship your determination letter of the alphabet within 180 days for Form 1023

If you have not heard from them by that time you tin can telephone call 877-829-5500 to enquire about your awarding.

Protect Your Business organisation & Personal Assets

Business organisation Banking

one. Opening a business concern depository financial institution account:

- Separates your personal avails from your visitor's assets, which is necessary for personal asset protection.

- Makes accounting and taxation filing easier.

To open a bank account for your nonprofit corporation y'all will typically need the post-obit:

- The EIN for the nonprofit

- A re-create of the nonprofit'south bylaws

- A copy of the articles of incorporation

Read our All-time Pocket-sized Business Banks review to find the right bank for your nonprofit'due south needs

ii. Getting a business credit card:

- Helps you separate personal and business expenses.

- Builds your company'southward credit history, which tin can be useful to raise capital letter subsequently.

Get Insurance

Business insurance helps y'all manage risks and focus on growing your business. The most mutual types of business insurance are:

- General Liability Insurance: A broad insurance policy that protects your business concern from lawsuits. Most minor businesses get general liability insurance.

- Professional Liability Insurance: A business insurance for professional service providers (consultants, accountants, etc.) that covers against claims of malpractice and other business concern errors.

- Workers' Bounty Insurance: A type of insurance that provides coverage for employees' task-related illnesses, injuries, or deaths.

Your Business Needs Insurance

Find out which policies your business needs and how much it will cost by getting a free quote today.

Call: 833-536-1478

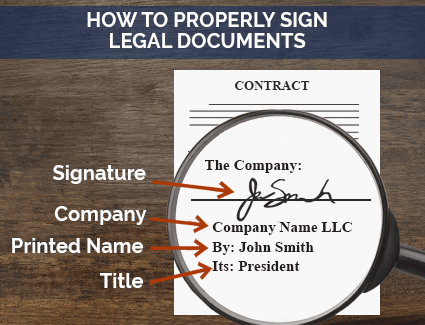

Properly Sign Legal Documents

Improperly signing a document as yourself and not equally a representative of the business organisation can leave you lot open to personal liability. When signing legal documents on behalf of your nonprofit , you could follow this formula to avoid problems:

- Formal proper noun of your organization

- Your signature

- Your name

- Your position in the business organisation equally its authorized representative

Encounter the image below for an example.

This ensures that y'all are signing on behalf of your nonprofit and non as yourself.

Quick Links

Business concern Insurance

How to Keep Your Nonprofit Compliant

What is an EIN?

What is a DBA?

Featured Articles

Source: https://howtostartanllc.com/start-a-501c3-nonprofit/

0 Response to "How To Set Up A 501c3 In Michigan"

Post a Comment